Empire Newsletter: Could bitcoin take a hit from Mt Gox creditors?

Don’t panic

Movement of bitcoin from the known Mt Gox wallet to a new address early Tuesday caused some, uh, concern in markets as investors fretted that $9 billion worth of bitcoin could be sold.

Obviously, that would be a huge pressure point on the market, but let’s be clear: That’s not the case…yet. And — depending on who you talk to — might not be the case at all.

Unlike the US bankruptcies we’ve talked about, the Mt Gox bankruptcy is quite murky even as we near the end of a 10-year-long process (Mt Gox went bankrupt in 2014).

But a combination of factors — the overseas bankruptcy, the missing bitcoin, etc — made this case look a lot different than, say, FTX. Clearly, the market’s feeling anxiety over it based on the drop we saw yesterday.

So let’s look at what we know.

Former CEO Mark Karpelès assured people that the move early Tuesday was made to prepare for distributions. The estate then put out a statement echoing Karpelès. None of this is out of the norm, as the trustee has to prepare for the distributions, which have a deadline of October 21.

Earlier this year, people on Reddit started posting that they were receiving emails from the estate to confirm their identity and account details, in what seemed to be one of the first moves to repay customers. The emails also said that distributions would be made in-kind, meaning that creditors would receive bitcoin or bitcoin cash instead of fiat. (Though some were able to receive fiat payouts.)

That followed previous reports in December of customers receiving payouts in yen.

Galaxy Research’s Alex Thorn offered some clarity in a research note late Tuesday, noting that the creditors had options for their payouts and some could opt for earlier payouts that took a bit off the top to make it more timely. Those willing to be patient could opt to wait a bit longer and receive a larger payout at a later date.

Thorn also believes that roughly 65,000 BTC/BCH will be returned to 20,000 individual creditors from now until September.

Here’s where things really get interesting. Thorn’s thesis on the distributions is slightly different from what we’ve seen from other research firms, many of which have said that they expect pressure on bitcoin’s price.

Speaking to funds with large claims, Thorn said that they’re “likely to distribute their BTC to LPs in-kind, and from speaking with several LPs in these funds, we do not believe there will be significant selling from this cohort.”

Overall, Thorn says the creditors he’s chatted with seem to be longer-term bitcoiners who wouldn’t be so willing to hit the sell button once the bitcoin’s moved to their wallet.

“Although it’s impossible to quantify, we believe the creditor base is comprised primarily of die-hard bitcoiners. Thousands of these creditors have waited 10 years for payouts and resisted compelling and aggressive claims’ offers during that time, suggesting they want their coins back,” he wrote.

But, we’re talking about billions of dollars in bitcoin here. The payout is tremendous and even 6,500 of the 65,000 bitcoin being sold could have a noticeable market impact. The question then becomes: What does the appetite look like?

There’s one last thing to add here and that’s that I’ve focused primarily on bitcoin, but bitcoin cash could see an entirely different response from creditors. Both K33 and Galaxy think that the BCH repayments could lead to “excess selling pressure” in BCH versus bitcoin.

— Katherine Ross

Data Center

- BTC is hovering around $67,000, down half a percent.

- AI tokens pull back: AR, AGIX and FET are all down more than 10% this week.

- Weekly volumes on DEXs Uniswap and Orca are up 40%, hitting $20.5 billion and $3.9 billion, respectively.

- Optimism inflows have outstripped Arbitrum over the past week, $146.5 million to $99 billion.

- Grayscale saw outflows of $100 million yesterday, while BlackRock’s inflows topped $100 million per Farside data.

Below my line

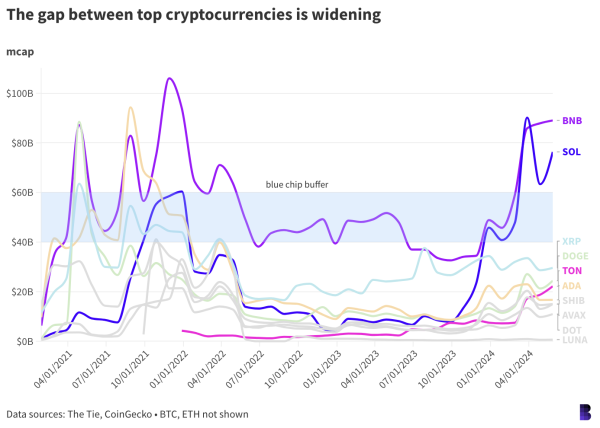

Toncoin is all the rage right now. But if it goes any higher, it’s destined to butt heads with crypto’s meaty blue-chip barrier.

There are dozens or even hundreds of blue-chip stocks in traditional finance. Most would say crypto really only has two: bitcoin (BTC) and ether (ETH).

BTC and ETH make up nearly three-quarters of crypto’s entire market cap and it seems unlikely to change without a sudden ripper altcoin season.

Others might say that solana (SOL) and binance coin (BNB) are blue-chip cryptocurrencies. It makes sense on the surface: both power well-used blockchain networks and have ties to some of the more long-standing and well-capitalized crypto companies in Binance and Solana Labs.

For the sake of this column, let’s use a very basic definition: Blue-chip cryptocurrencies are those with $60 billion market cap or more in our current and previous cycles.

BNB and SOL are at about $90 billion and $80 billion, respectively, and the next most valuable cryptocurrency is XRP (not counting stablecoins and lido staked eth), which hasn’t cracked the $40 billion mark for over two years.

ADA, XRP and DOGE were valued much closer to BNB during the previous cycle

Cardano (ADA), dogecoin (DOGE), binance coin (BNB) and XRP briefly crossed over into blue-chip territory last cycle. Shiba Inu (SHIB) and polkadot (DOT) had potential but bounced off the edges of the blue-chip buffer — a moat between top assets and the masses — starting at $40 billion.

This time around, the blue-chip buffer is turning out to be a no man’s land for market caps. Only XRP has made it close over the past year, but toncoin (TON), recently at record highs, seems ready to take a shot.

The Telegram-adjacent network is seeing a bunch of activity: trading bots, shared ad revenue with content creators, the push-button-receive-crypto “game” Notcoin and cute tokenomics stunts have all contributed to a healthy growth narrative around Toncoin.

Whether it can break through the market’s psychological wall is another story.

— David Canellis

The Works

- BlackRock’s IBIT became the world’s largest bitcoin fund, taking the crown from Grayscale.

- The SEC was ordered to pay $1.8 million in legal fees in the Debt Box case, a judge ruled.

- Deutsche Bank thinks that blockchain technology could help banks respond to margin compression, Bloomberg reported.

- Former FTX executive Ryan Salame was sentenced to 7.5 years in prison.

- The New York Stock Exchange announced a collaboration with CoinDesk Indices to “develop specific product offerings.”

The Morning Riff

Q: Should we be concerned about the Mt Gox repayments?

As I wrote above, this process has taken a decade. That’s honestly a lifetime in crypto. It wouldn’t be surprising if some folks want to make a little cash off of their coins, but I don’t think fretting about the would’ve, could’ve, should’ve of it all does the market — or your mental health — any good. It’s better to get the repayments over with, and this clears a major negative overhang for bitcoin.

Even if a lot of bitcoin is dumped on exchanges, there may have been no better time for this event to take place thanks to the bitcoin ETFs and institutional demand. (I’m a broken record, I know.)

— Katherine Ross

Think of the Mt. Gox payouts as the yin to BlackRock’s yang.

Do I buy that the whole saga has molded a diamond-handed gang of bitcoiners that will hold the line, no matter how high or low we go? Eh. Maybe.

I agree though: Whatever happens, bitcoin markets will be just as relieved as creditors to put the whole thing to bed. Sooner the payouts happen, the sooner any dumps can be priced and we can concern troll about the next doomer narrative.

— David Canellis